Hawaii Power of Attorney Forms

A Hawaii power of attorney form is used for providing a person the right to carry out tasks on behalf of another person. There are numerous reasons why a principal may choose to nominate an agent (the person receiving the powers), of which include the principal having a lack of time, travel commitments, anticipating future health problems, a need to have their tax matters handled, and much more.

Power of attorney forms come in two (2) general types, “durable” and “non-durable”. If a POA is durable, it continues to stay effective even if the principal enters into a state of incapacitation (unable to communicate).

Definition: “means a writing or other record that grants authority to an agent to act in the place of the principal…” (source: § 551E-1)

Types (6)

| Ad. Directive | Durable | General | Limited | Minor | Vehicle |

Which Form is Right for Me? | |

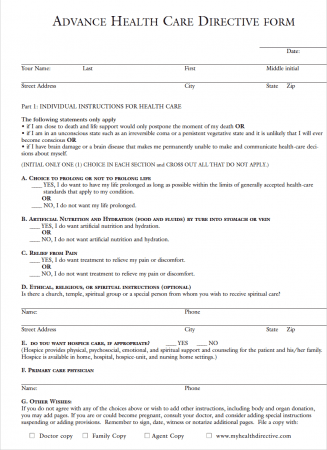

| Advance Directive | Used for long-term medical planning. Allows the person completing the form (the principal) to nominate a person to be the go-to representative for their medical treatment, should the principal be unable to communicate on their own. Also provides the principal with space to establish their preferences on treatment, such as if they would want CPR or other life-saving procedures. |

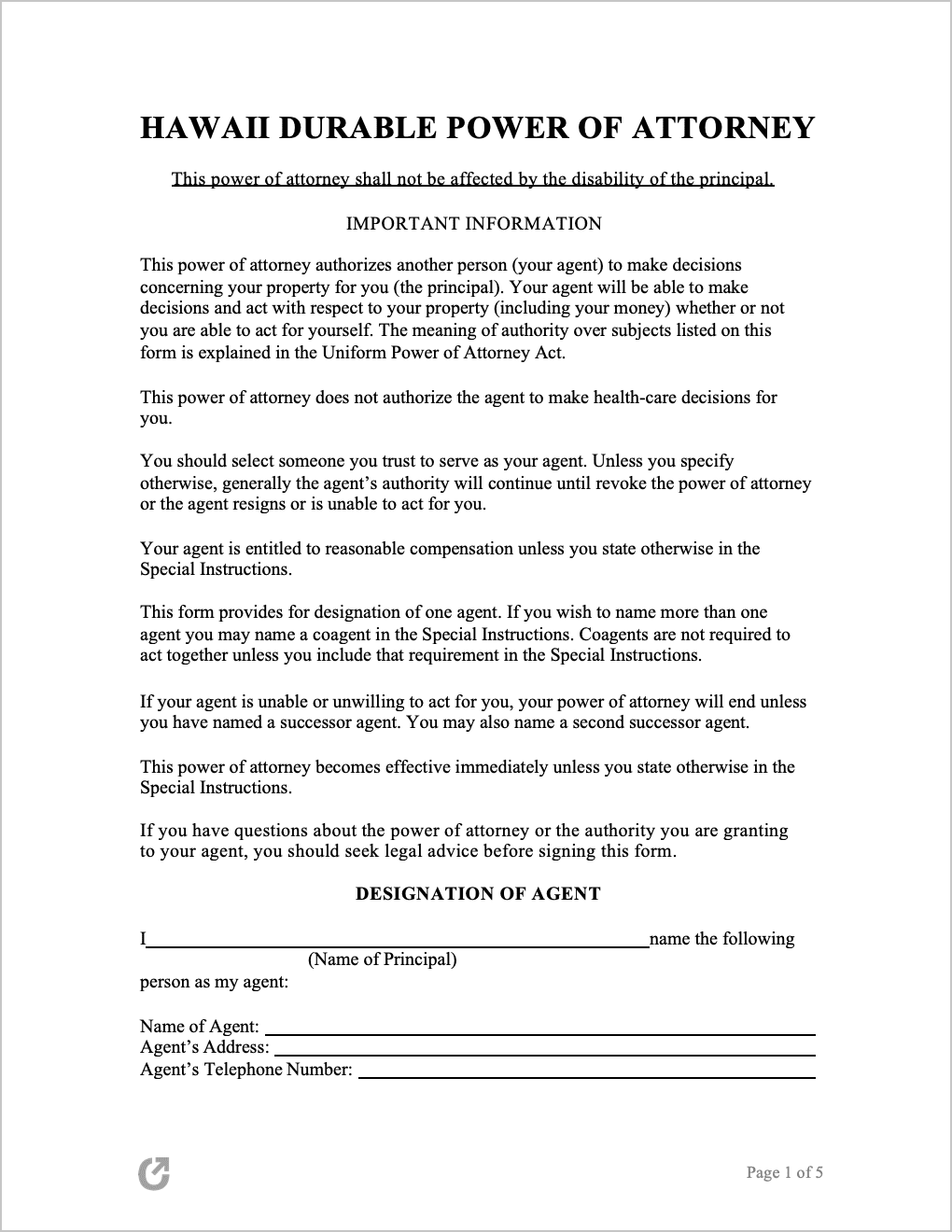

| Durable | The standard document for assigning sweeping powers over one’s assets and estate. Unlike the general POA below, the form is “durable”, meaning it is upheld regardless of the principal’s mental or physical state. |

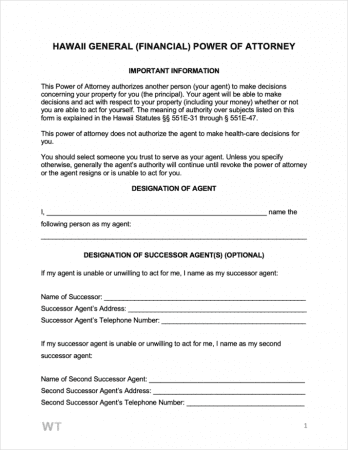

| General | Used for granting power over financial-related decisions. Very similar to the durable POA with the exception that form automatically terminates in the event the principal becomes incapacitated. |

| Limited | A simple POA that limits the scope of the agent’s power to one (1) or a few specific tasks. It is not durable, meaning it will terminate if the principal becomes incapacitated. Useful for giving someone permission for a one-time task, such as cashing a check or signing a form. |

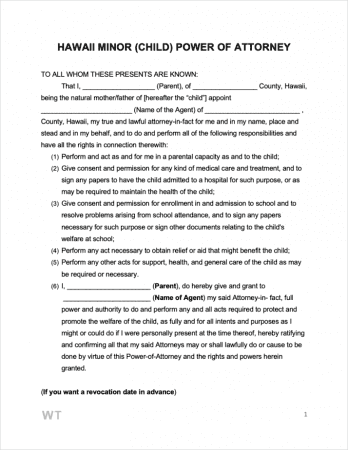

| Minor Child | A contract that allows parents or guardians to temporarily provide someone they trust with the right to take care of their child or children. |

| Motor Vehicle | Makes it possible for someone to give another person permission to buy, sell, or register a vehicle on their behalf. |