Louisiana Power of Attorney Forms

A Louisiana power of attorney form gives individuals over eighteen (18) the ability to appoint agents, or “mandataries,” to make legal, financial, or other decisions on their behalf. Upon completion and the principal’s signature, the agent receives authority to act for them, using the form to interact with institutions for specific tasks. While each power of attorney targets distinct purposes, a special variant exists for customizable needs. These agreements, known as “mandates,” typically serve singular objectives like property sales or tax filings and remain valid until revoked or the principal’s death. Mandataries must strictly adhere to the directive, executing the individual’s wishes to their fullest ability.

Types (6)

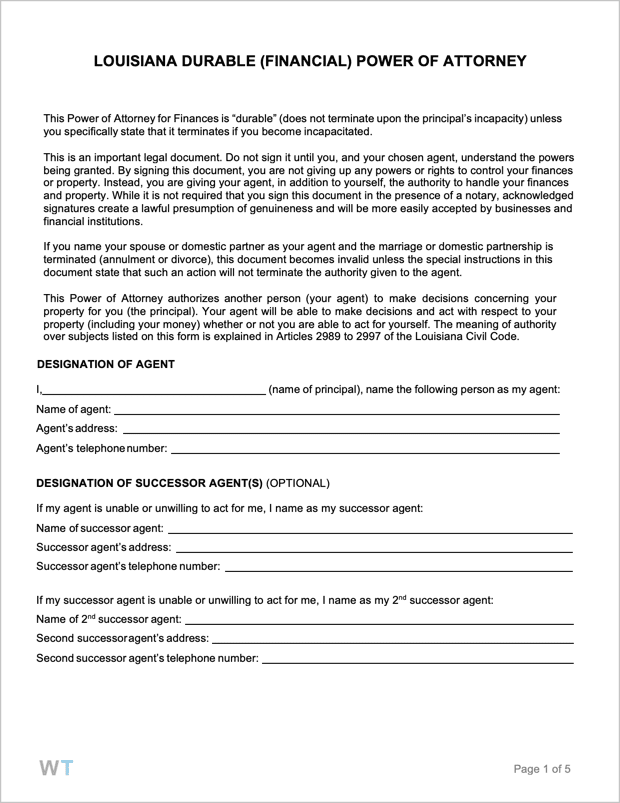

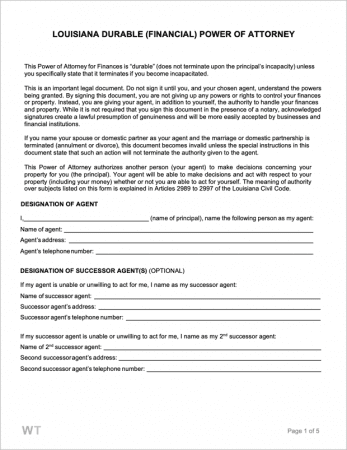

Durable Power of Attorney – Durability here is defined as the condition by which a POA form will continue to be exercised, regardless of whether or not the principal is determined by law to be incapable of making their own sound decisions.

Durable Power of Attorney – Durability here is defined as the condition by which a POA form will continue to be exercised, regardless of whether or not the principal is determined by law to be incapable of making their own sound decisions.

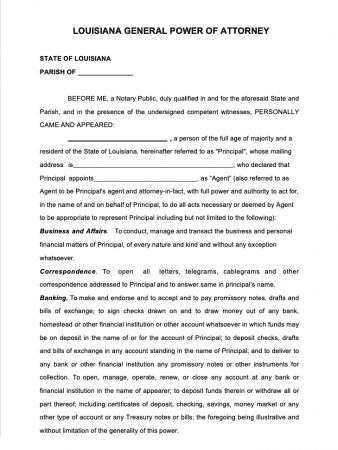

General (Financial) Power of Attorney – A principal who decides that they do not want the powers bestowed on their mandatory by the POA to continue if they become incapacitated should ensure they use a general type of document.

General (Financial) Power of Attorney – A principal who decides that they do not want the powers bestowed on their mandatory by the POA to continue if they become incapacitated should ensure they use a general type of document.

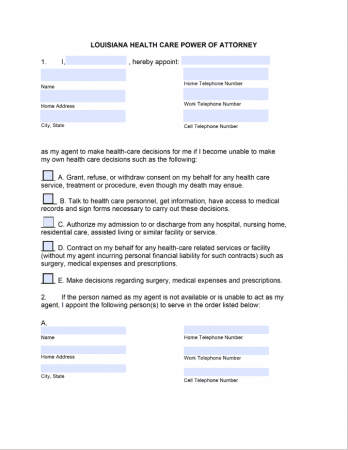

Health Care (Medical) Power of Attorney – A form that is completed with the intention of ensuring the wishes of the Principal in regards to their own health care will be respected even if they become incapacitated.

Health Care (Medical) Power of Attorney – A form that is completed with the intention of ensuring the wishes of the Principal in regards to their own health care will be respected even if they become incapacitated.

Download: PDF

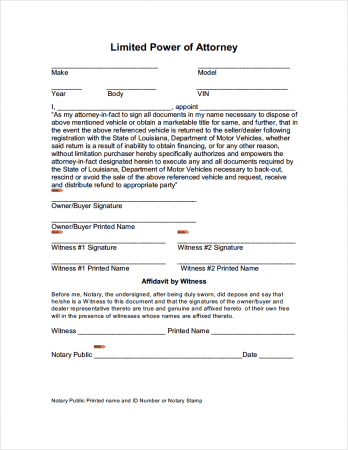

Limited (Special) Power of Attorney – A POA that only lasts until the completion of the specific action that is detailed within, unless another date or circumstance is specified.

Limited (Special) Power of Attorney – A POA that only lasts until the completion of the specific action that is detailed within, unless another date or circumstance is specified.

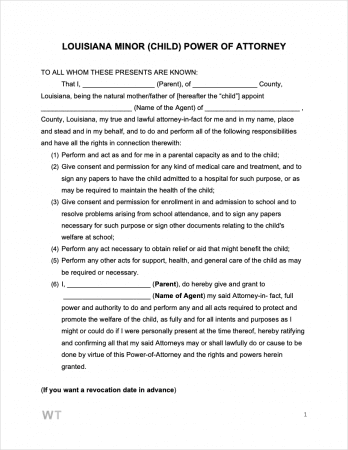

Minor Child Power of Attorney – This form addresses the need for parents, on occasion, to involve another party in the process of caring for their children when they are absent from them for any reason.

Minor Child Power of Attorney – This form addresses the need for parents, on occasion, to involve another party in the process of caring for their children when they are absent from them for any reason.

Motor Vehicle (DMV) Power of Attorney – When filed with the DMV, this form empowers another party who is nominated by a motor vehicle owner to preside over a range of issues concerning the owner’s vehicle.

Motor Vehicle (DMV) Power of Attorney – When filed with the DMV, this form empowers another party who is nominated by a motor vehicle owner to preside over a range of issues concerning the owner’s vehicle.

Download: PDF

Laws & Signing Requirements

- Louisiana Power of Attorney Laws – Title XV, Article 2985 to Article 3034

- Definition of Procuration (Article 2987): This is a legal action where a principal grants a representative the power to act on their behalf in legal matters. The principal can directly authorize the representative or designate another individual with whom the representative will act on behalf of the initial party.

- Definition of Mandate (Article 2989): This represents an agreement wherein the principal authorizes another individual, called the mandatory, to manage one or more specific tasks on their behalf.

- Signing Requirements (RS 28:224): The signing must occur in the presence of at least two (2) witnesses. Additionally, it must include an assessment from a qualified psychologist or doctor confirming that the principal comprehends the authority delegated to the agent.