New Mexico Power of Attorney Forms

A New Mexico Power of Attorney Form lets a resident of NM nominate an adult of their choosing to act in their place regarding their personal property, finances, vehicle, health matters, tax filing, and essentially any other topic of their choosing. The person selected is known as the “agent”, and should be consulted with prior to their assignment so they understand the responsibilities they will have to the principal (person completing the form). The agent’s powers can be set to terminate on a specific date, upon the incapacitation of the principal, or immediately after the principal signs their name to the form.

Types (6)

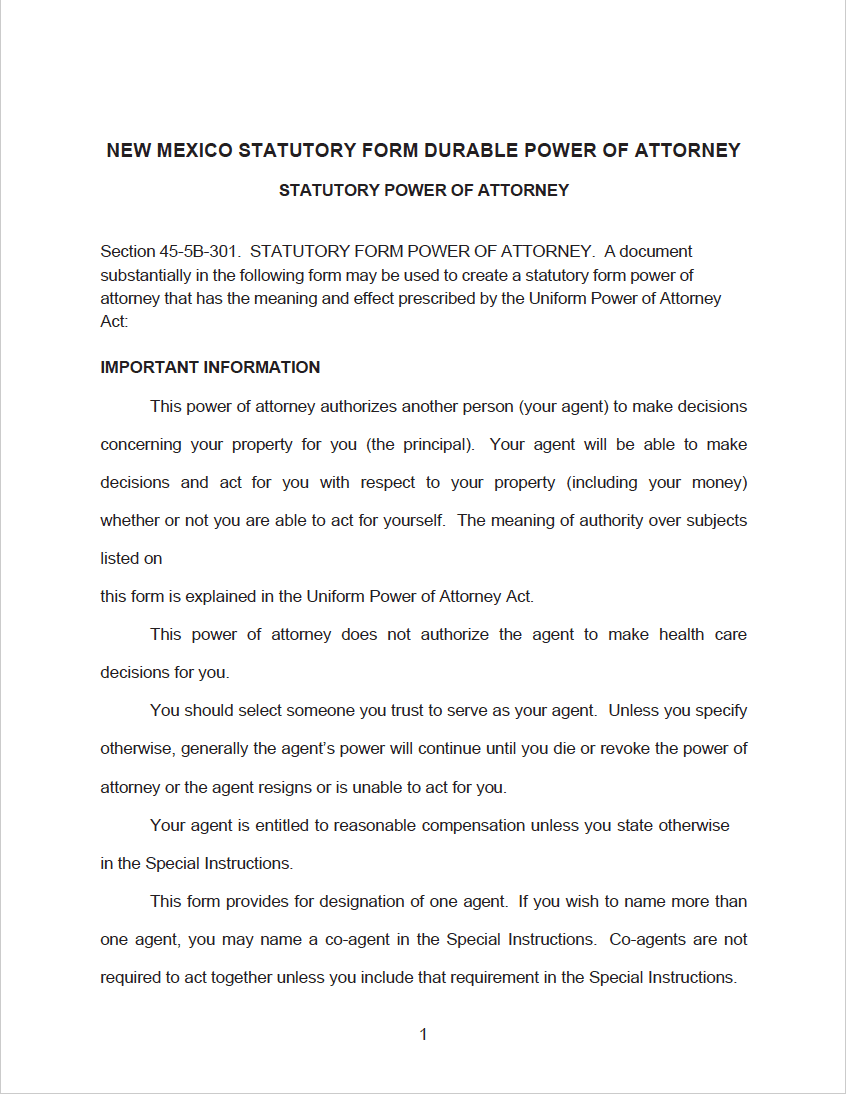

Durable Power of Attorney – The main type of POA – the form continues in effect regardless of the mental state of the principal (although it can be terminated by the principal at any time so long they are in sound mind).

Durable Power of Attorney – The main type of POA – the form continues in effect regardless of the mental state of the principal (although it can be terminated by the principal at any time so long they are in sound mind).

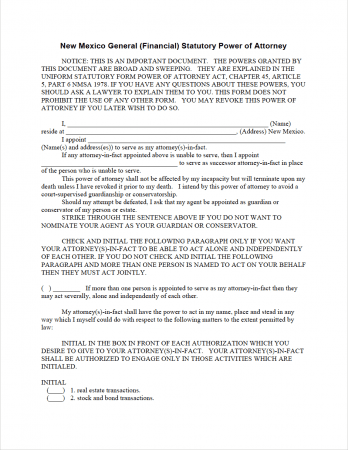

General (Financial) Power of Attorney – Used for delegating decision-making powers concerning financial matters of any kind. Used for specifying broad powers that can extend on a recurring or one-time basis depending on the preferences of the principal.

General (Financial) Power of Attorney – Used for delegating decision-making powers concerning financial matters of any kind. Used for specifying broad powers that can extend on a recurring or one-time basis depending on the preferences of the principal.

Limited (Special) Power of Attorney – Limits the tasks the agent must carry out to only those noted in this form.

Limited (Special) Power of Attorney – Limits the tasks the agent must carry out to only those noted in this form.

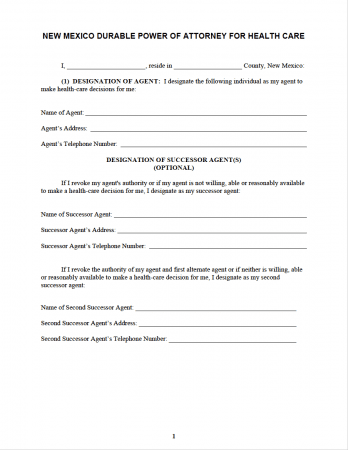

Medical Power of Attorney – This legal form, also referred to as an Advance Healthcare Directive, allows a person to select a trusted person with the right to make decisions on their behalf in a medical setting. The form also includes a section in which the principal can specify how they feel about certain practices, such as life support and more.

Medical Power of Attorney – This legal form, also referred to as an Advance Healthcare Directive, allows a person to select a trusted person with the right to make decisions on their behalf in a medical setting. The form also includes a section in which the principal can specify how they feel about certain practices, such as life support and more.

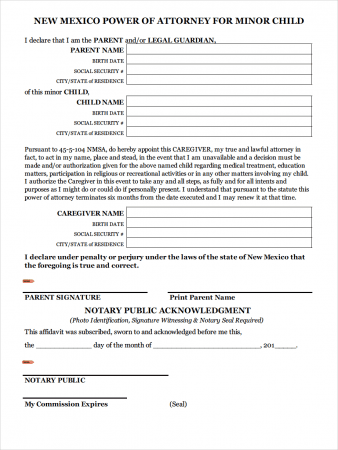

Minor Child Power of Attorney – Parents and guardians are required by law to ensure the wellbeing of their children. If they will be away from their child/children for a considerably long time, they should choose a trusted person to take care of their children. The form allows them to give the temporary agent to sign forms, make medical decisions, and other matters.

Minor Child Power of Attorney – Parents and guardians are required by law to ensure the wellbeing of their children. If they will be away from their child/children for a considerably long time, they should choose a trusted person to take care of their children. The form allows them to give the temporary agent to sign forms, make medical decisions, and other matters.

Download: PDF

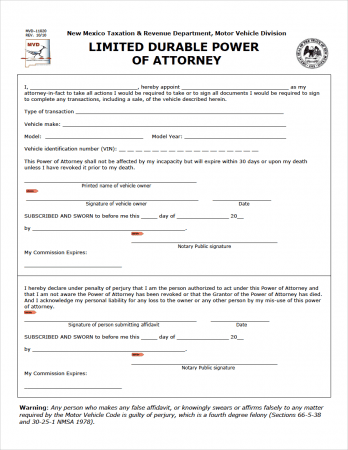

Motor Vehicle Power of Attorney (Form MVD-11020) – Provided by the state, this is a single one (1) page form specifically used for giving a person rights to handle matters regarding a motor vehicle.

Motor Vehicle Power of Attorney (Form MVD-11020) – Provided by the state, this is a single one (1) page form specifically used for giving a person rights to handle matters regarding a motor vehicle.

Download: PDF

Laws & Signing Requirements

- New Mexico Power of Attorney Laws – Chapter 45-5B, “Uniform Power of Attorney Act” and Chapter 24, Article 7a, “Uniform Health-Care Decisions Act”

- State Definition of Power of Attorney (§ 45-5B-102(G)) – “means a writing or other record that grants authority to an agent to act in the place of the principal, whether or not the term “power of attorney” is used.”

- State Definition of Advance Health-Care Directive (§ 24-7A-1) – “means an individual instruction or a power of attorney for health care made, in either case, while the individual has capacity.”

- Signing Requirements

- General / Durable Power of Attorney (§ 45-5B-105) – Signed by the principal + notarized.

- Advance Health-Care Directive (§ 24-7A-2) – Signed by the principal (at a minimum). Should also be notarized to ensure it is accepted by those who are presented the POA.