Texas Power of Attorney Forms

A Texas power of attorney (POA) is a type of legal form used for providing a person with permission to make decisions and/or carry out tasks on another person’s behalf. The individual completing the form is known as the “principal”, whereas the person receiving powers is the “agent”. Alternatively, the agent can also go by the title of “attorney-in-fact”.

The nine types of POAs grant power over different personal affairs, such as the care of children, business management, or the filing of taxes, to name a few. Additionally, POAs can be made durable or non-durable. If the POA will be for long-term planning (such as in a medical emergency), the form should be “durable”, which is a term that refers to the agreement only terminating upon the principal’s death or manual revocation.

- Laws: Title 2, Ch. 752 & Title 2, Ch. 166

Types (6)

| Ad. Directive | Durable | General | Limited | Minor | Vehicle |

Which Form is Right for Me? | |

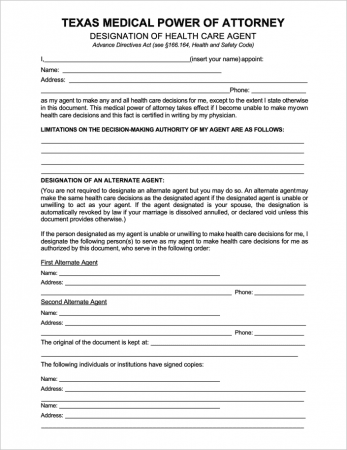

| Advance Directive | Used for establishing a go-to person (agent) who has the responsibility of communicating one’s medical wishes to doctors should the person be unable to do so themselves. Acts as a hybrid form, combining elements from a medical POA and a living will. |

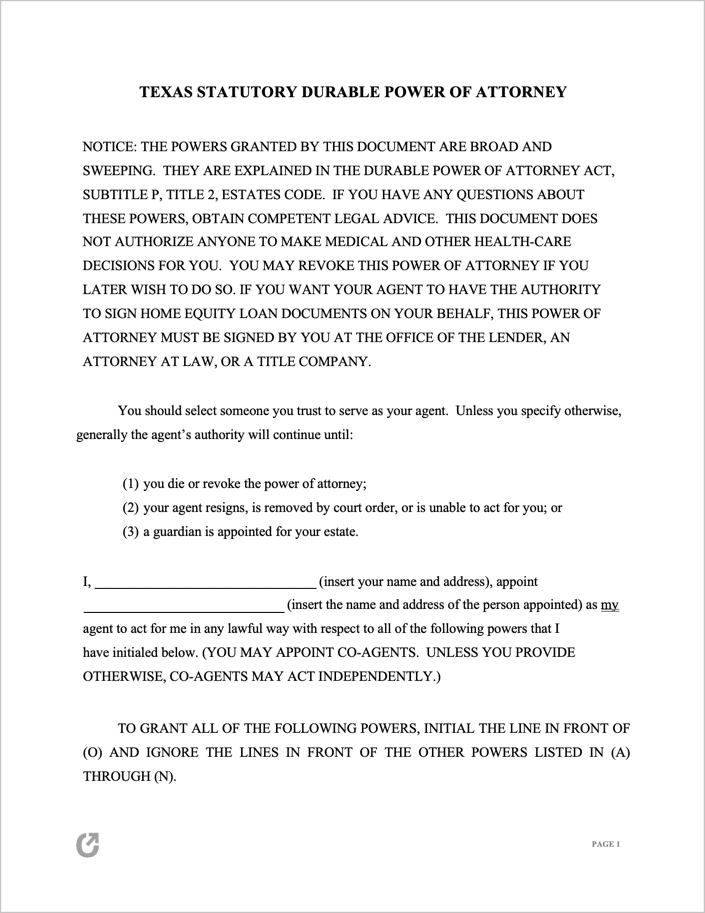

| Durable | The official state-provided form for granting encompassing permissions regarding any non-medical decisions. Once signed, the form remains in effect until the revokes it or passes away. |

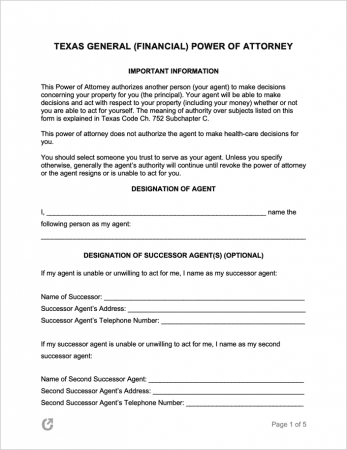

| General | Like the durable form above, but is less of a long-term planning document. If a person needs to provide someone they trust with the ability to oversee their assets (for a period of 1 year, for example), they can do so with this form. Should the principal become incapacitated (unable to communicate effectively), the POA will terminate. |

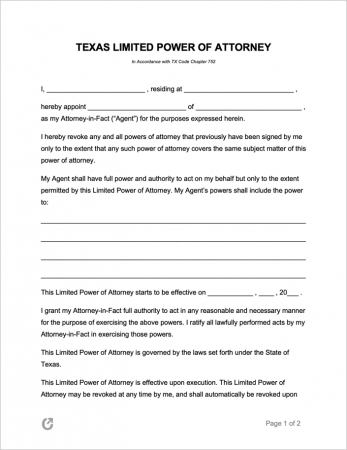

| Limited | A multi-purpose form used for assigning specific powers to an agent for a short-term tasks. Example: Giving a person permission to sign a document on their behalf. |

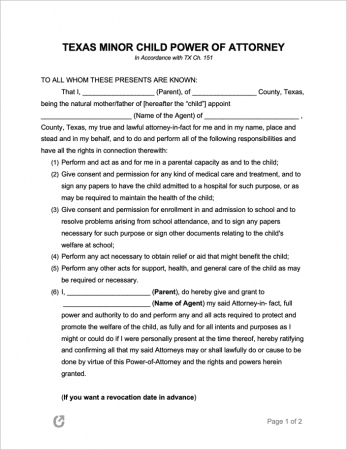

| Minor Child | Used when parents or guardians are unable to fulfill their parental or guardianship duties, typically due to their job or unforeseen circumstances. Allows for the nominating of a family member or friend to take care of their child(ren) for a period of time not to exceed one (1) year. |

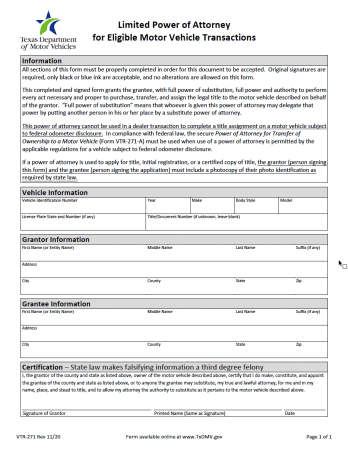

| Motor Vehicle | Provided by the Texas DMV for granting an agent (referred to as the grantee) with the power and authority to perform every act necessary in order to successfully purchase, transfer, and/or assign the legal title of a motor vehicle owned by a grantor. |