Virginia Power of Attorney Forms

The Virginia Power of Attorney Forms are personal-use legal documents that bestow authority to a trusted individual to handle real estate, finances, taxes, a motor vehicle, and any other subset of a person’s life. Depending on the type chosen, they can be durable or non-durable. By selecting a durable type form, the agent’s powers would remain in effect regardless of the mental status of the principal. This type of form should only be used after careful consideration by the principal due to the amount of power that is given to the agent. It is highly suggested that principals elect a secondary agent (and possibly a third) to cover in the event the primary agent cannot perform their duties.

On the other hand, a person will commonly agree to act as an agent because of:

- Their desire to help the principal,

- Their sense of filial responsibility, and/or

- The opportunity to generate income.

Types (6)

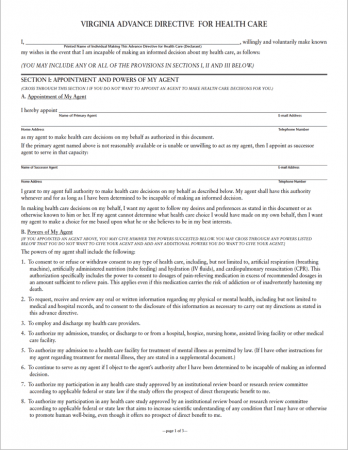

Advance Directive for Health Care – Serves two (2) main purposes: 1) it acts as a legal record of a person’s end-of-life preferences (in treatment), and it 2) assigns a representative to communicate the person’s preferences to doctors and other medical professionals.

Advance Directive for Health Care – Serves two (2) main purposes: 1) it acts as a legal record of a person’s end-of-life preferences (in treatment), and it 2) assigns a representative to communicate the person’s preferences to doctors and other medical professionals.

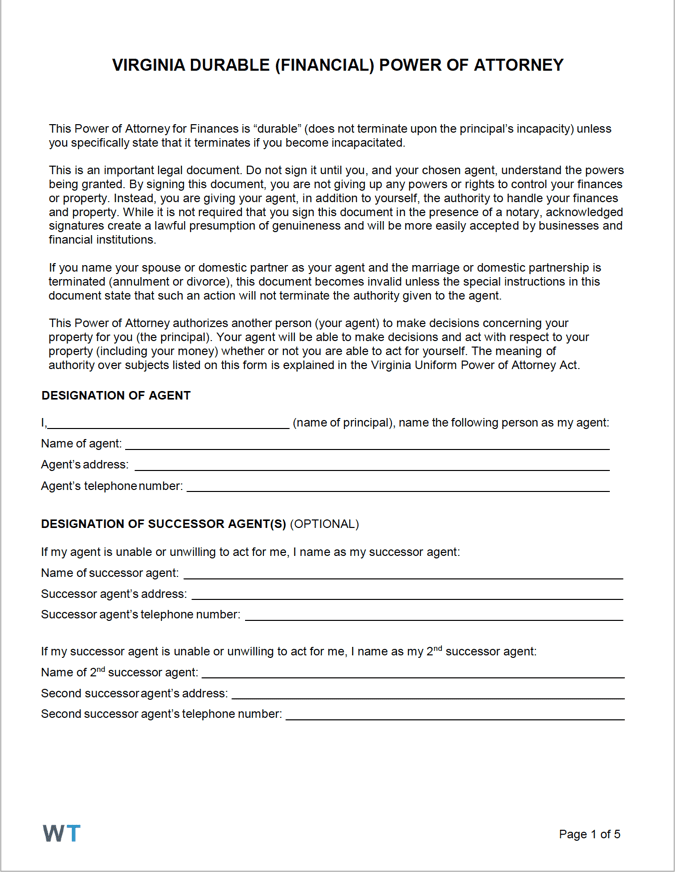

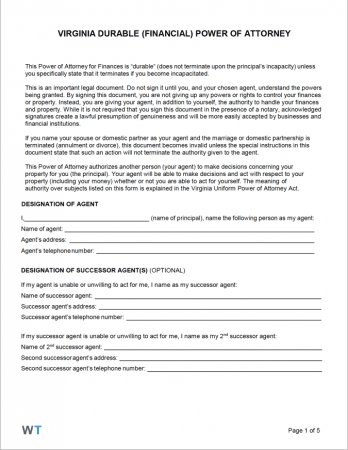

Durable Power of Attorney – A document that gives an agent authority over the principal’s finances. The powers assigned continue unaffected should the principal suffer from an emergency that leaves them mentally ill. Terminates upon death.

Durable Power of Attorney – A document that gives an agent authority over the principal’s finances. The powers assigned continue unaffected should the principal suffer from an emergency that leaves them mentally ill. Terminates upon death.

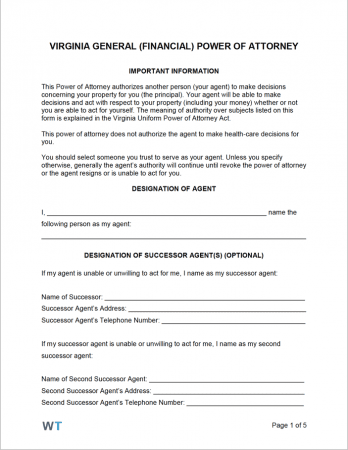

General (Financial) Power of Attorney – Used for giving broad powers to an agent (like a durable POA), but is restricted by legal terms that prevent the POA from continuing after the principal becomes incapacitated.

General (Financial) Power of Attorney – Used for giving broad powers to an agent (like a durable POA), but is restricted by legal terms that prevent the POA from continuing after the principal becomes incapacitated.

Limited (Special) Power of Attorney – Grants an agent with the authority to perform acts or make certain decisions for a principal for a non-definite length of time and/or in the specific circumstances that have been specified in the document.

Limited (Special) Power of Attorney – Grants an agent with the authority to perform acts or make certain decisions for a principal for a non-definite length of time and/or in the specific circumstances that have been specified in the document.

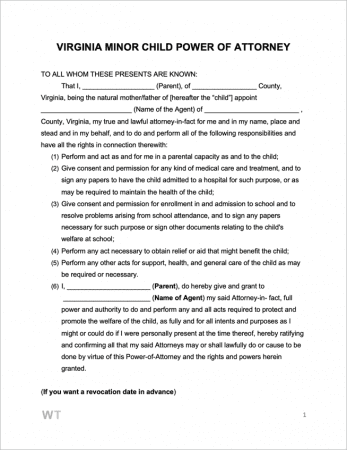

Minor Child Power of Attorney – A legal instrument used for giving an adult the right to make parental decisions over their children for a specific length of time. Commonly used by parents that are leaving on active duty in the military.

Minor Child Power of Attorney – A legal instrument used for giving an adult the right to make parental decisions over their children for a specific length of time. Commonly used by parents that are leaving on active duty in the military.

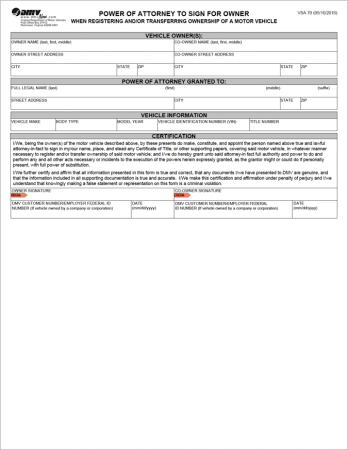

Motor Vehicle Power of Attorney (VSA 70) – Issued by the state’s DMV to allow the owner of a car or truck a means of giving another the right to handle administrative tasks regarding the vehicle.

Motor Vehicle Power of Attorney (VSA 70) – Issued by the state’s DMV to allow the owner of a car or truck a means of giving another the right to handle administrative tasks regarding the vehicle.

Download: PDF

Laws & Signing Requirements

- Virginia Power of Attorney Laws – Title 64.2, Chapter 16 and Title 54.1, Chapter 29, §§ 54.1-2981 to 54.1-2993

- State Definition of Power of Attorney (VA Code § 64.2-1600) – “means a writing or other record that grants authority to an agent to act in the place of the principal, whether or not the term power of attorney is used.”

- State Definition of Advance Directive/ Medical Power of Attorney (§ 54.1-2982) – “means (i) a witnessed written document, voluntarily executed by the declarant in accordance with the requirements of § 54.1-2983 or (ii) a witnessed oral statement, made by the declarant subsequent to the time he is diagnosed as suffering from a terminal condition and in accordance with the provisions of § 54.1-2983.”

- Signing Requirements

- General / Durable Power of Attorney (§ 64.2-1603) – Signed by the principal + notarized.

- Advance Directive / Medical Power of Attorney (§ 54.1-2983) – Principal’s signature must be viewed by two (2) witnesses (who also sign the form).