North Dakota Rental Lease Agreement Templates

Download the North Dakota Rental Lease Agreements to legally collect rent from tenant(s) in exchange for permitting them with the right to move into a vacant property. Landlords will complete a lease after verifying the tenant’s background via a comprehensive rental application. In order for the legally-binding relationship to be established, each party must legibly sign the contract after sitting down to discuss each section. Although negotiation can occur for residential agreements, it is typically reserved for commercial leases due to the limited rights tenants have under the contracts.

Types (6)

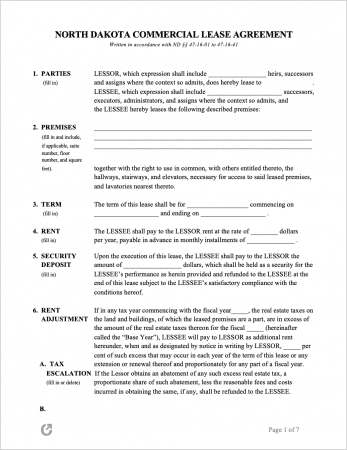

Commercial Lease Agreement – A heavily negotiated contract that, once completed and signed, permits a tenant to run their business out of the property.

Commercial Lease Agreement – A heavily negotiated contract that, once completed and signed, permits a tenant to run their business out of the property.

Download – Adobe PDF, Word (.docx)

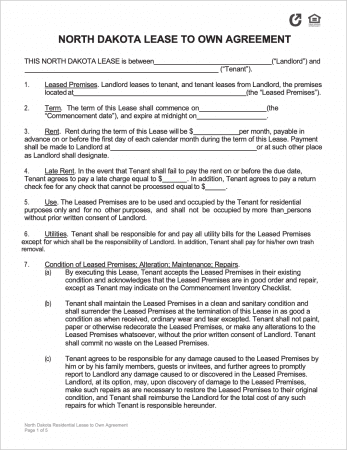

Lease to Own Agreement – Homeowners in search of a buyer for their property can use the form to first lease the property to tenants, with the added condition that the tenant(s) can purchase the dwelling if they so choose.

Lease to Own Agreement – Homeowners in search of a buyer for their property can use the form to first lease the property to tenants, with the added condition that the tenant(s) can purchase the dwelling if they so choose.

Download – Adobe PDF, Word (.docx)

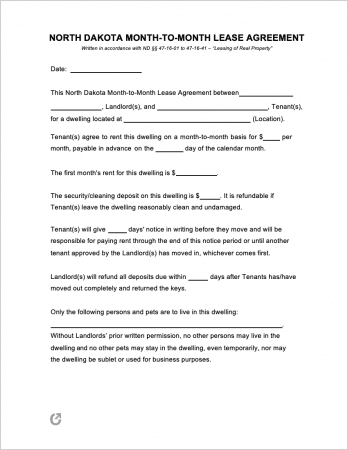

Month-to-Month Lease Agreement – An auto-renewing lease that has terms of one (1) month. If neither party cancels the contract it will continue on indefinitely. Required notice for canceling is thirty (30) days.

Month-to-Month Lease Agreement – An auto-renewing lease that has terms of one (1) month. If neither party cancels the contract it will continue on indefinitely. Required notice for canceling is thirty (30) days.

Download – Adobe PDF, Word (.docx)

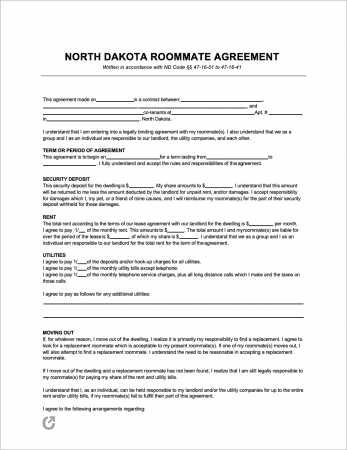

Roommate Agreement – Used for minimizing disagreements among renters sharing the same property.

Roommate Agreement – Used for minimizing disagreements among renters sharing the same property.

Download – Adobe PDF, Word (.docx)

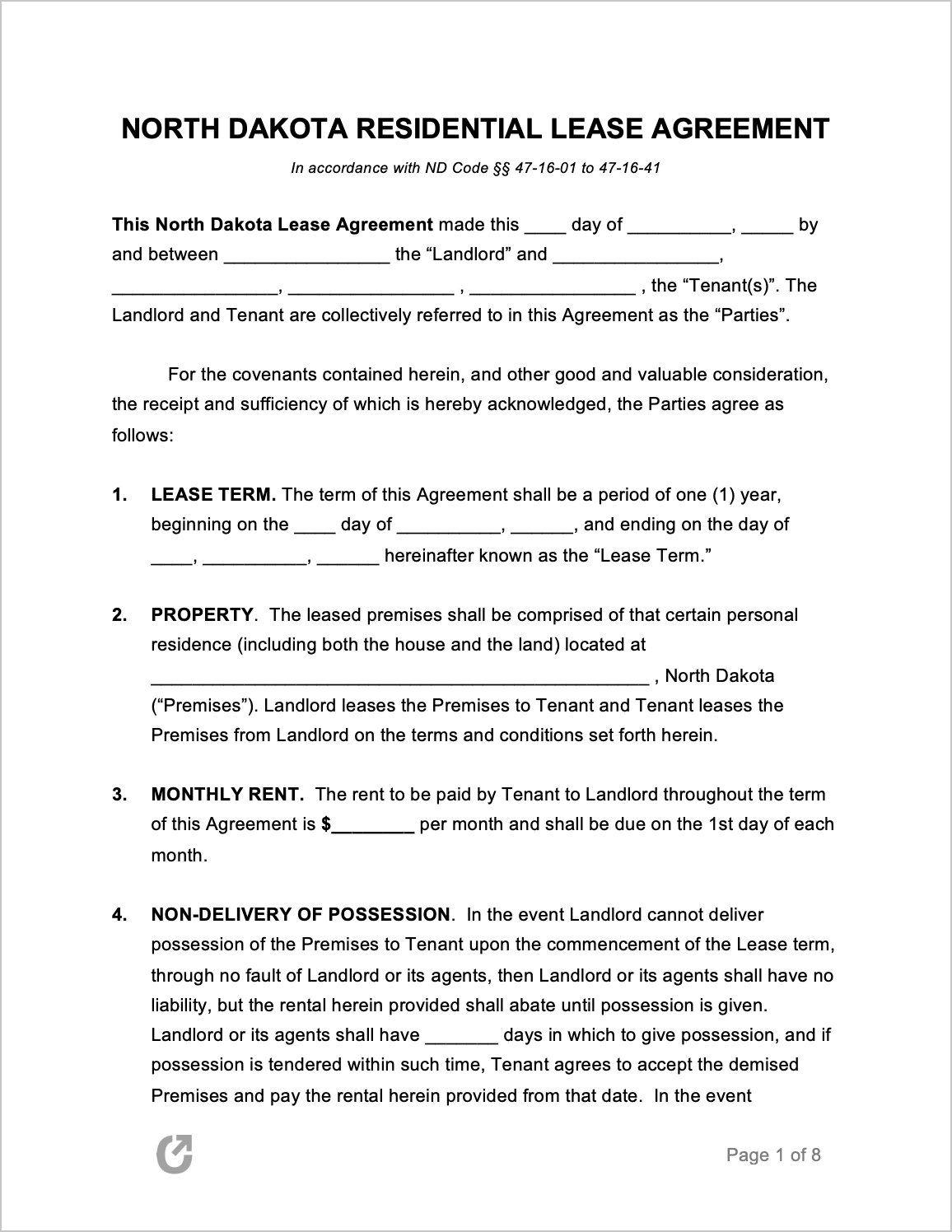

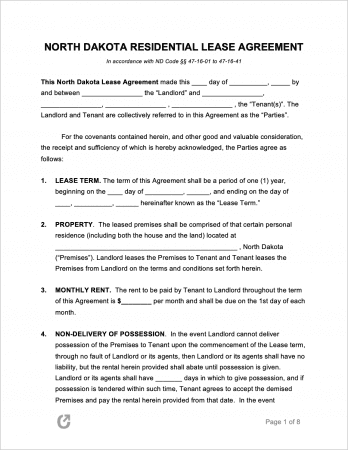

Standard Residential Lease Agreement – Used by landlords to lease property on a yearly basis. The most frequently used lease out of the options provided.

Standard Residential Lease Agreement – Used by landlords to lease property on a yearly basis. The most frequently used lease out of the options provided.

Download – Adobe PDF, Word (.docx)

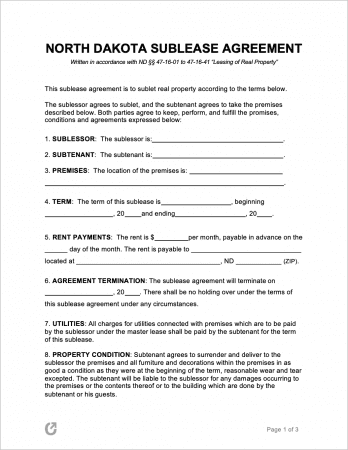

Sublease Agreement – Used for subletting a residential property. Permission should be acquired from the landlord unless the lease specifically permits it.

Sublease Agreement – Used for subletting a residential property. Permission should be acquired from the landlord unless the lease specifically permits it.

Download – Adobe PDF, Word (.docx)

What is a North Dakota Lease Agreement?

A North Dakota Lease Agreement establishes rules and obligations both a landlord and tenant(s) are bound to until the lease’s termination. The forms can be used for both residential and commercial property so long as the correct option is selected. Before a landlord sits down with a tenant to sign a lease they should thoroughly vet the tenant-applicant via a state-specific rental application.

State Laws & Guides

Laws: Ch. 47-16 “Leasing of Real Property” (PDF VERSION) OR Ch. 47-16 (ONLINE VERSION)

Landlord-Tenant Guides / Handbooks

- North Dakota – Tenant Rights and Responsibilities.pdf

- North Dakota Tenant Rights.pdf

- Eviction for Tenants (Handbook).pdf

When is Rent Due?

As outlined by § 47-16-20, rent is due as stated by the rental agreement. There is no statute regarding a grace period for the late payment of rent.

Landlord’s Access

Emergency (§ 47-16-07.3(1)): Landlords do not have to provide notice before entering a rental unit in an emergency.

Non-Emergency (§ 47-16-07.3(2)): In non-emergencies, landlords must notify and receive the tenant’s consent (including a time they may enter) before accessing the rental. Landlords can only enter during reasonable times and in a reasonable manner.

Landlord’s Duties

In accordance with ND § 47-16-13.1, all landlords in the state must comply with the following obligations:

- Comply with all applicable building/housing codes that relate to the health and safety of tenants;

- Supply constant running water to tenants in addition to reasonable amounts of hot water and heat (unless not required by local or state law);

- Ensure tenants have access to garbage receptacles that allow for the safe and sanitary disposal of trash and other rubbish.

- Make repairs to the rental unit to ensure it is safe and livable for tenants; and

- Keep all common areas both clean and safe and maintain all electrical, plumbing, and HVAC systems (that were originally included in the lease).

Tenant’s Duties

State law § 47-16-13.2 outlines tenants obligations as the following:

- Comply with all applicable health and safety codes established by local and/or state provisions;

- Keep that part of the premises that the tenant occupies and uses as clean and safe as the condition of the premises permit.

- Throw away garbage and other waste in a clean and safe manner;

- Act in a way that doesn’t disturb other tenants and their enjoyment of the rental and common areas.

- Use (and keep reasonable clean) all fixtures, appliances, and systems as included in the lease contract.

- Refrain from deliberately or accidentally destroying, damaging, or removing any part of the rental. Do not knowingly permit any other person to do so as well.

Required Disclosures

- Lead Paint Disclosure: Federal law requires landlords to disclose any known lead-based hazards in rental units built before 1978 by giving tenants a pamphlet discussing lead-based hazards in homes.

- Statement Regarding the Property’s Condition (§ 47-16-07.2): The landlord must provide the tenant with a statement describing the state (condition) of the rental unit at the time of entering into the lease. Both parties must agree to the information in the statement and sign it.

Security Deposits

Maximum (§ 47-16-07.1(1)): Deposits cannot be greater than one (1) months’ rent. If the tenant has been convicted of a felony offense, the landlord may demand up to two (2) month’s rent. Landlords are permitted to charge convicted felons more for deposits to give landlords an incentive to lease to said felons.

Pet Deposit (§ 47-16-07.1(2)): Landlords can charge tenants an additional pet deposit if the tenant(s) have a pet that is not a service animal or companion animal required due to a disability. The deposit cannot exceed two-thousand five-hundred dollars ($2,500) or an amount equivalent to two months’ rent (whichever amount is greater).

Returning to Tenant (§ 47-16-07.1(3)): Landlords must return collected security deposits within thirty (30) days after the lease’s termination. A landlord who intends to keep a portion (or all) of the security deposit must itemize all deductions and deliver or mail the list in addition to a written notice to the tenant at their last known address.

Deposit Interest (§ 47-16-07.1(1 & 3)): Must be given to tenants locked into a lease of nine (9) months or longer. Accrued interest can be used in conjunction with the security deposit for deducting certain expenses (below).

Uses of the Deposit (§ 47-16-07.1(3)): Landlords can deduct from security deposits to cover the following expenses:

- Unpaid rent;

- Deteriorations/injuries to the rental unit that resulted from the tenant’s pet or from negligence of the tenant(s) or their guest(s).

- Cleaning costs or other repairs that were the responsibility of the tenant(s) and have to be completed in order to return the rental unit to the state it was in when the tenant(s) first took possession. Does not include reasonable (expected) wear and tear.