Alabama Power of Attorney Forms

Alabama power of attorney forms empower a designated individual (the “agent”) to make personal or business decisions on behalf of another person. Individuals often sign the document due to an inability to make decisions due to health issues, being out of the state or country and requiring a document to be signed, or needing an accountant to file their taxes.

The individual completing the form (the “principal”) should select an agent they know well and trust. Suitable agents may include family members, close friends, or professionals like attorneys. Choosing a reliable agent ensures that the principal’s best interests are protected, and their wishes are respected.

| State Laws: Alabama Uniform Power of Attorney Act |

Types (6)

| Ad. Directive | Durable | General | Limited | Minor | Vehicle |

Which Form is Right for Me? | ||

Type | Definition | Signing Requirements |

| Durable | A durable power of attorney form gives an agent the ability to make financial and personal decisions on behalf of the principal. The durability aspect ensures that the agent’s abilities stay effective even if the principal becomes incapacitated. | The principal and notary public must sign (§ 26-1A-105). |

| General | A general power of attorney form provides an agent with broad decision-making authority on behalf of the principal. Unlike a durable power of attorney, this document terminates if the principal becomes incapacitated. | The principal must have their signature notarized (§ 26-1A-105). |

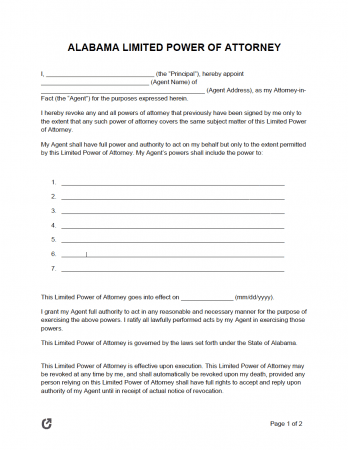

| Limited | A limited power of attorney form allows an agent to handle specific tasks or make decisions in particular situations for the principal. This form is helpful for short-term arrangements and does not extend to all aspects of the principal’s life. | Notarization mandatory (§ 26-1A-105). |

| Medical | A medical power of attorney form designates an agent to make healthcare decisions on behalf of the principal. This form comes into play when the principal cannot make medical decisions for themselves, ensuring their medical preferences are honored. | The principal and two (2) witnesses must sign (§ 22-8A-4(4)). |

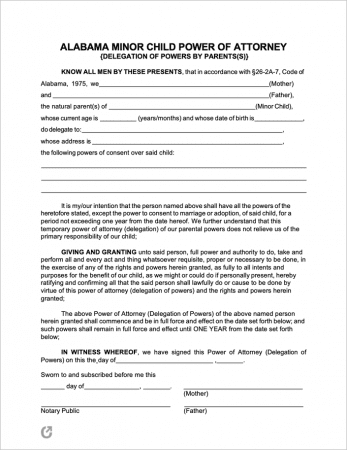

| Minor Child | A minor child power of attorney form enables a parent or guardian to appoint a temporary caretaker for their child. This form allows the designated agent to make decisions about the child’s education, healthcare, and other needs during the parent’s absence. | Notarization mandatory (§ 26-1A-105). |

| Motor Vehicle | A motor vehicle power of attorney form grants an agent the authority to handle tasks related to the principal’s vehicle. This process may include registration, title transfers, and other vehicle-related matters on behalf of the principal. | The car’s owner and the agent must sign. |