Colorado Power of Attorney Forms

Colorado power of attorney forms allow a principal (person issuing the form) to designate a representative for financial and medical matters.

Types (6)

Which Form is Right for Me? |

Type | Definition | Signing Requirements |

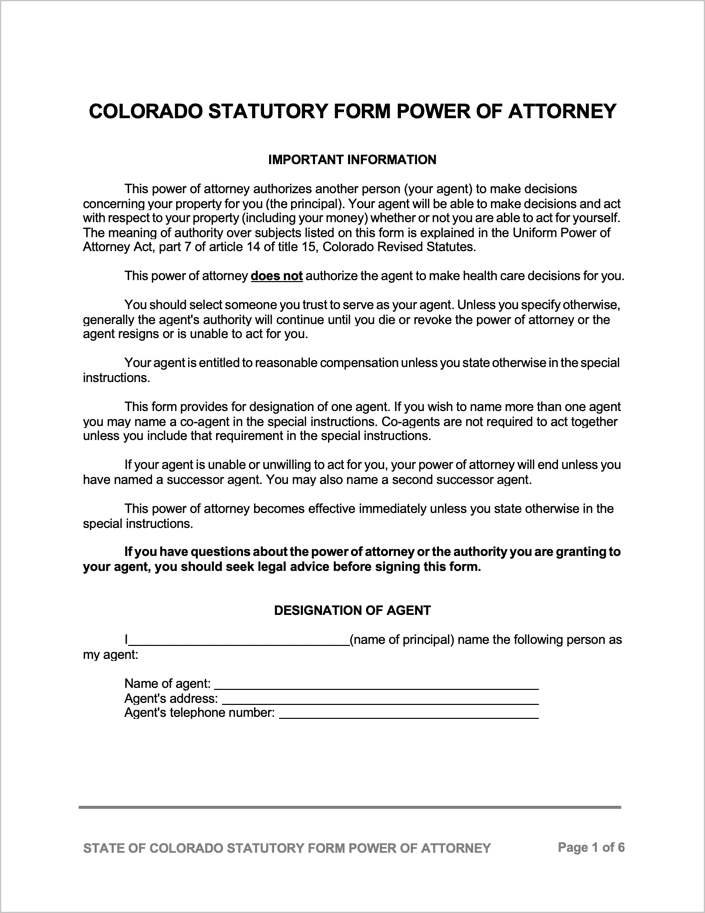

| Durable | This form enables a trusted individual to manage a principal’s assets and estate. The agent’s authority remains even if the principal becomes incapacitated. Termination occurs if the principal revokes it or passes away. | The principal and notary public must sign (§ 15-14-705). |

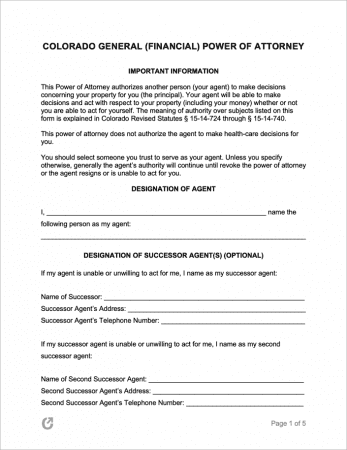

| General | Grants an agent similar powers to a durable power of attorney, but the power ends if the principal becomes incapacitated. | Signatures from the principal and notary public required (§ 15-14-705). |

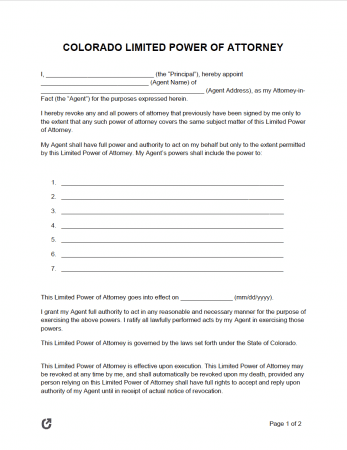

| Limited | Outlines specific, limited powers for an agent, typically for one or a few tasks. The form does not provide use for long-term planning. | The principal must sign before a notary public (§ 15-14-705). |

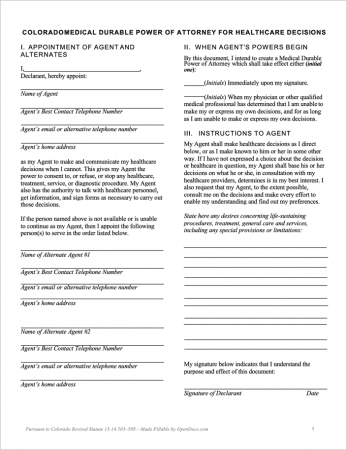

| Medical | A life planning document designating an agent to communicate with healthcare providers about the principal’s preferred treatments. It remains effective indefinitely unless revoked by the principal, often paired with a living will for detailed treatment preferences. | The principal and two (2) witnesses must sign (§ 15-18-106(1)). |

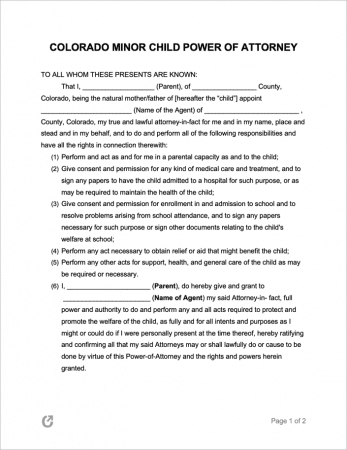

| Minor Child | Assign temporary legal responsibility to a designated person for caring for a parent or guardian’s child when they cannot do so. | Parent or guardian signature and notarization mandatory (§ 15-14-705). |

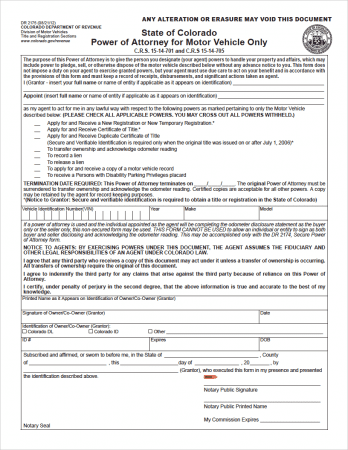

| Motor Vehicle | Authorizes an agent to handle motor vehicle-related affairs, such as registration, on behalf of the principal. | The grantor and notary public must enter their signatures. |