Mississippi Power of Attorney Forms

Mississippi Power of Attorney Forms are documents used for giving a person (the “agent”) the right to represent another person’s health, finances, and/or business matters. The person that completes the form is formally known as the “principal”, and can be anyone of sound mind.

Depending on the POA selected, the agent can be given wide decision-making powers that remain active regardless of the principal’s mental status, OR can be limited and only remain in effect until the task(s) have been completed. For those only interested in a non-binding and relatively low-risk POA, a limited power of attorney is recommended. However, consulting with a licensed attorney will be able to provide advice unique to your situation (and is the recommended option).

Types (6)

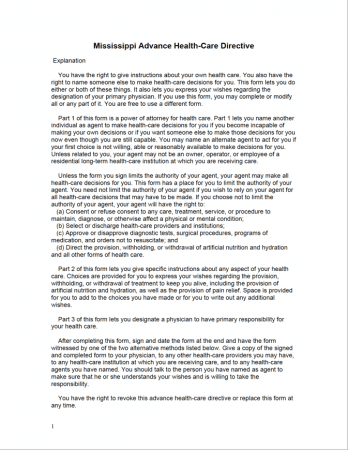

Advance Health-Care Directive – Serves two (2) major purposes: allows a person to assign a healthcare representative AND allows them to spell-out how they’d like to be taken care of when they are nearing the end of their life.

Advance Health-Care Directive – Serves two (2) major purposes: allows a person to assign a healthcare representative AND allows them to spell-out how they’d like to be taken care of when they are nearing the end of their life.

Download: PDF

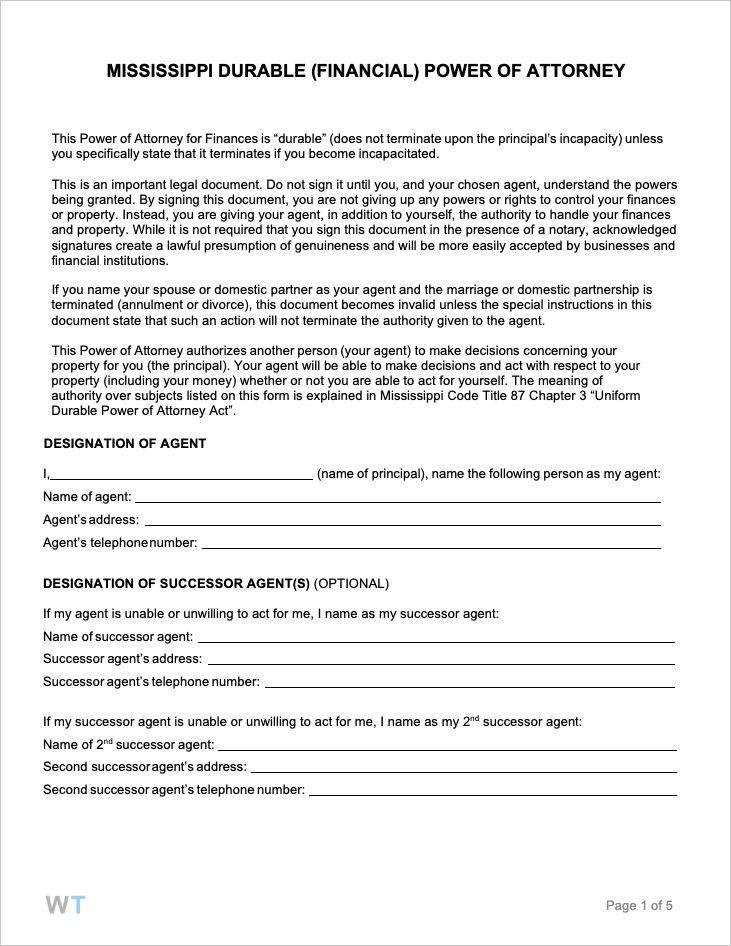

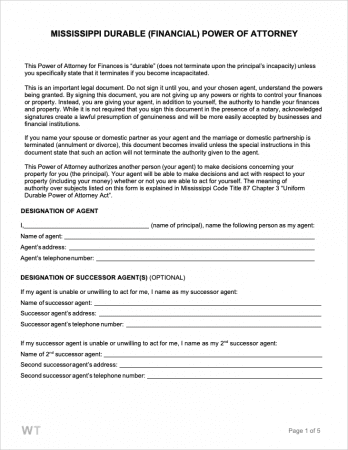

Durable Power of Attorney – This type of POA only terminates upon the principal’s death, OR in by the principal’s manual revocation. This form is serious and should involve considerable planning on behalf of the principal.

Durable Power of Attorney – This type of POA only terminates upon the principal’s death, OR in by the principal’s manual revocation. This form is serious and should involve considerable planning on behalf of the principal.

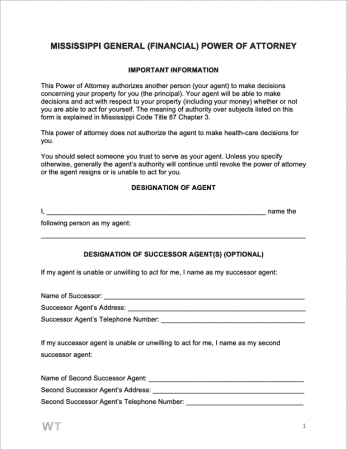

General (Financial) Power of Attorney – Gives a designated agent the means to carrout out decisions/tasks relating to the principal’s finances. All powers halt if the principal dies or becomes incapacitated.

General (Financial) Power of Attorney – Gives a designated agent the means to carrout out decisions/tasks relating to the principal’s finances. All powers halt if the principal dies or becomes incapacitated.

Limited (Special) Power of Attorney – The customizable option. Limits the agent to the specific powers included in the form.

Limited (Special) Power of Attorney – The customizable option. Limits the agent to the specific powers included in the form.

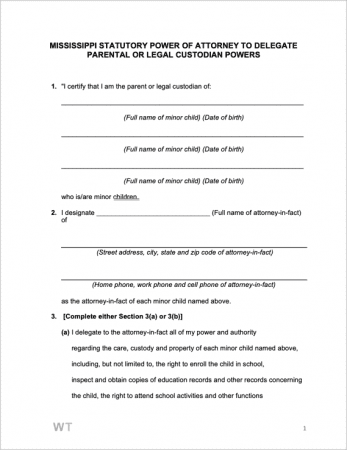

Minor Child Power of Attorney – Provides parents with a means of designating temporary parental rights to a person they trust. Commonly used by parents leaving on active duty, those that need to serve a prison sentence, and more.

Minor Child Power of Attorney – Provides parents with a means of designating temporary parental rights to a person they trust. Commonly used by parents leaving on active duty, those that need to serve a prison sentence, and more.

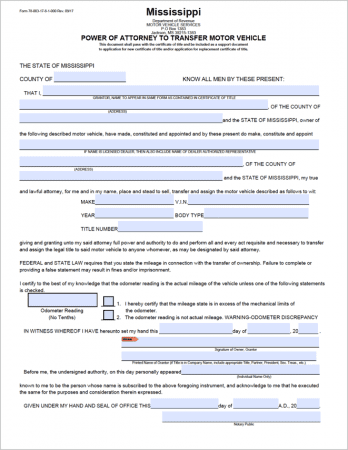

Motor Vehicle Power of Attorney (Form 78-003) – Once filed with the Mississippi Department of Revenue, the form allows a party appointed by the principal to sell, transfer, and/or assign their vehicle to another person.

Motor Vehicle Power of Attorney (Form 78-003) – Once filed with the Mississippi Department of Revenue, the form allows a party appointed by the principal to sell, transfer, and/or assign their vehicle to another person.

Download: PDF

Laws & Signing Requirements

- Mississippi Power of Attorney Laws – Title 87, Ch. 3 “Uniform Durable Power of Attorney Act” and Title 41, Ch. 41 “Uniform Health-Case Decisions Act”

- State Definition of Advance Health-Care Directive (§ 41-41-203) – “means an individual instruction or a power of attorney for health care.”

- Signing Requirements

- Advance Health-Care Directive / Medical Power of Attorney (§ 41-41-205) – The POA must be signed by the principal in the presence of:

- Two (2) witnesses, OR

- A Notary Public

- Advance Health-Care Directive / Medical Power of Attorney (§ 41-41-205) – The POA must be signed by the principal in the presence of: