South Carolina Power of Attorney Forms

A South Carolina Power of Attorney Form serves as an official statement that a person (the “attorney-in-fact” or “agent”) has the power to handle broad or specific tasks on behalf of the person completing the form (the “principal”). The agent selected should be someone that the principal knows well, such as family or a family friend. When completing the form, the principal should be as specific as possible to avoid granting the attorney-in-fact too much power over their life. If the principal finds that they made the POA too broad, they can revoke it and issue another power of attorney at any time.

All power of attorney forms, regardless of the type, terminate upon the death of the principal.

Types (6)

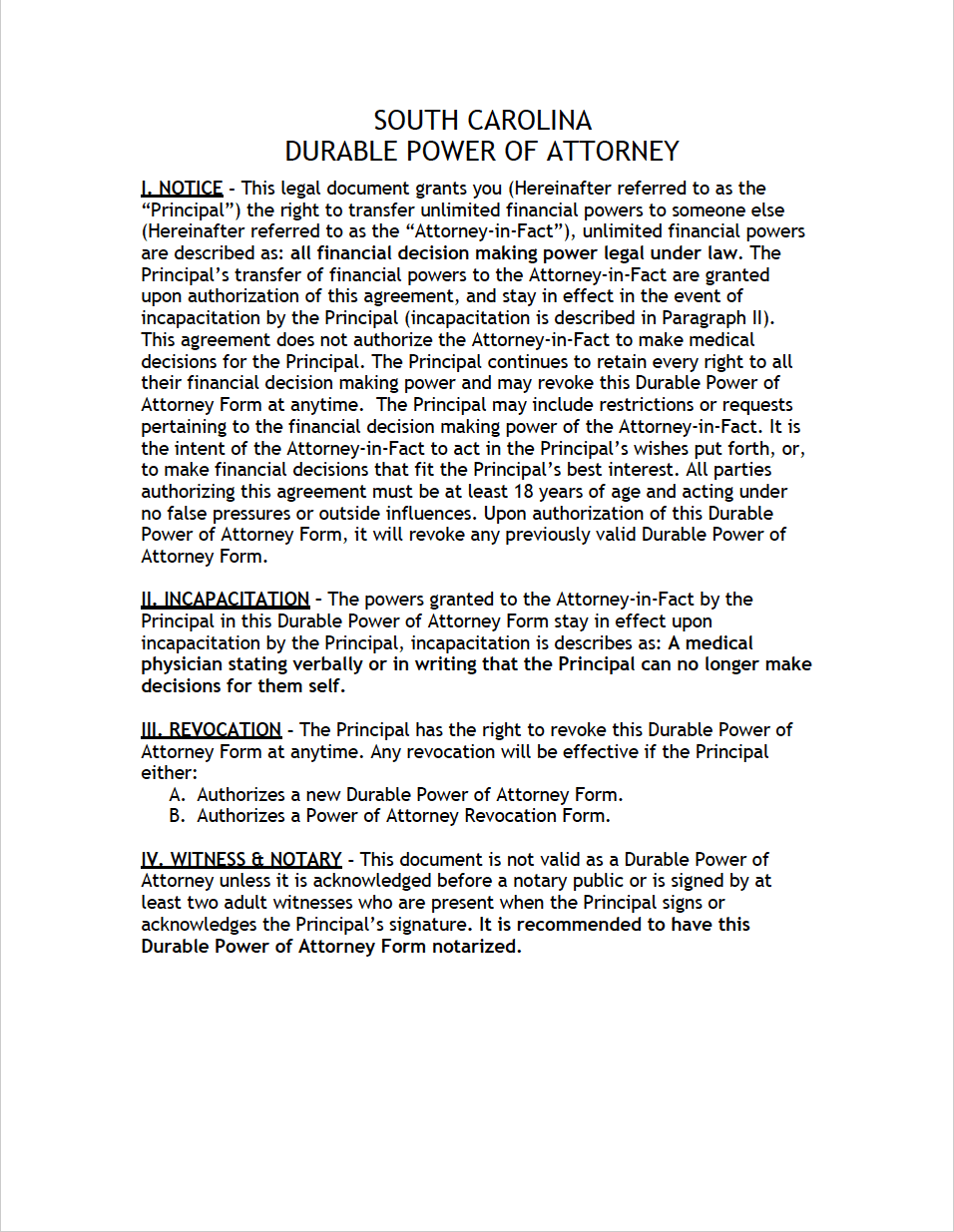

Durable Power of Attorney – Used for giving a person (the “attorney-in-fact”) powers over one’s finances. Because it is durable, it will stay in effect regardless of the medical status of the principal.

Durable Power of Attorney – Used for giving a person (the “attorney-in-fact”) powers over one’s finances. Because it is durable, it will stay in effect regardless of the medical status of the principal.

Download: PDF

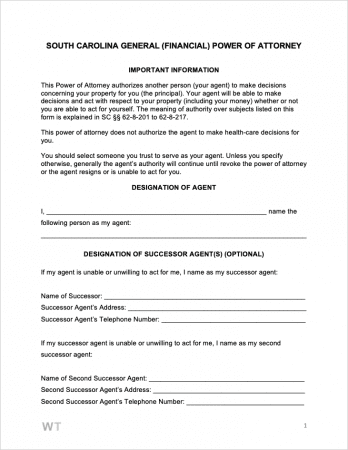

General (Financial) Power of Attorney – A broad type of POA that covers all financial matters relating to the principal. Can be revoked anytime using a revocation form (below).

General (Financial) Power of Attorney – A broad type of POA that covers all financial matters relating to the principal. Can be revoked anytime using a revocation form (below).

Limited (Special) Power of Attorney – For granting highly specific powers. A non-durable form.

Limited (Special) Power of Attorney – For granting highly specific powers. A non-durable form.

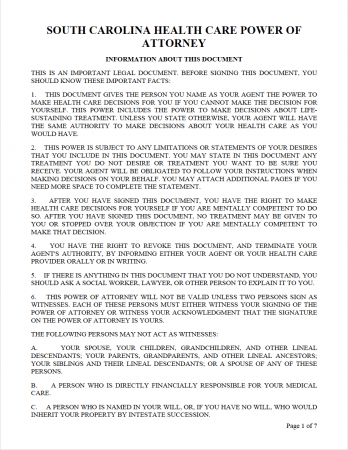

Medical Power of Attorney – One of the most commonly used types, the document allows one to grant one (1) person with the responsibility of communicating their end-of-life wishes (when they no longer can themselves).

Medical Power of Attorney – One of the most commonly used types, the document allows one to grant one (1) person with the responsibility of communicating their end-of-life wishes (when they no longer can themselves).

Download: PDF

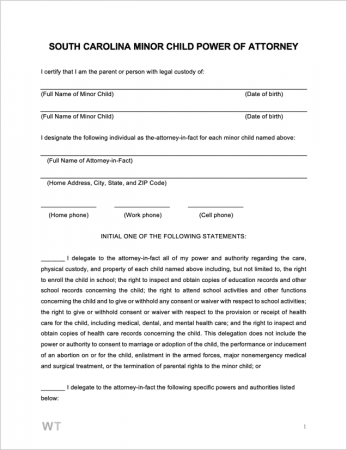

Minor Child Power of Attorney – A form completed by a parent(s) for giving a trusted friend or family member with temporary parental powers over their child.

Minor Child Power of Attorney – A form completed by a parent(s) for giving a trusted friend or family member with temporary parental powers over their child.

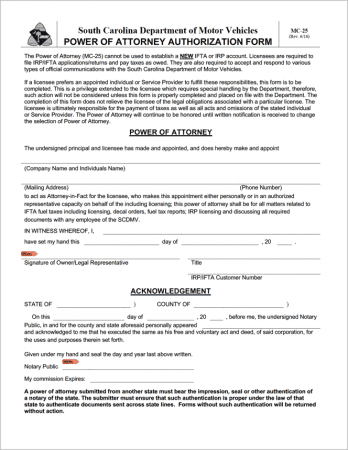

Motor Vehicle Power of Attorney (Form MC-25) – A state-issued legal document, the form allows anyone to appoint an individual or service provider with the right to complete certain actions on their behalf (regarding their vehicle).

Motor Vehicle Power of Attorney (Form MC-25) – A state-issued legal document, the form allows anyone to appoint an individual or service provider with the right to complete certain actions on their behalf (regarding their vehicle).

Laws & Signing Requirements

- South Carolina Power of Attorney Laws – Title 62, Article 8 and Title 62, Article 5

- Signing Requirements

- General / Durable Power of Attorney (§ 62-8-105) – Signed by 2 witnesses.

- Health Care Power of Attorney / Advance Directive (§ 62-5-504) – Must be signed by 2 witnesses. Notarization is optional, although recommended.