Wisconsin Power of Attorney Forms

The Wisconsin Power of Attorney Forms legally affirms an agreement for a party known as the “Agent” to represent a party known as the “Principal” in the matters and way(s) as specified in the selected form. Examples of duties an Agent may carry out for the Principal include:

- Picking up their children from school when the Principal is out of state,

- Ensuring end-of-life wishes are followed if incapacitation occurs, and

- Managing their rental property

Types (6)

Durable Power of Attorney – Allows an individual to elect another party to represent their interests in relation to their finances (bank accounts, possessions, and so on). Important note: the durable nature of the form means it does not terminate if the principal is medically designated as “incapacitated”.

Durable Power of Attorney – Allows an individual to elect another party to represent their interests in relation to their finances (bank accounts, possessions, and so on). Important note: the durable nature of the form means it does not terminate if the principal is medically designated as “incapacitated”.

General (Financial) Power of Attorney – Used for delegating financial tasks to a trusted person, known as the “agent”. Almost identical to the “durable-statutory poa” except it is non-durable.

General (Financial) Power of Attorney – Used for delegating financial tasks to a trusted person, known as the “agent”. Almost identical to the “durable-statutory poa” except it is non-durable.

Limited (Special) Power of Attorney – States, in a clear and unambiguous manner, the specific requirement(s) an agent is required to follow when carrying out any duties as their attorney-in-fact.

Limited (Special) Power of Attorney – States, in a clear and unambiguous manner, the specific requirement(s) an agent is required to follow when carrying out any duties as their attorney-in-fact.

Medical Power of Attorney (Form F-00085) – A form used for giving a trusted friend or family member the right to handle medical decisions if/when the principal is mentally unable to communicate their wishes. The form only goes into effect after incapacitation.

Medical Power of Attorney (Form F-00085) – A form used for giving a trusted friend or family member the right to handle medical decisions if/when the principal is mentally unable to communicate their wishes. The form only goes into effect after incapacitation.

Minor Child Power of Attorney – Transfers parental duties to an agent for a specific length of time (or until the parents manual revoke the POA).

Minor Child Power of Attorney – Transfers parental duties to an agent for a specific length of time (or until the parents manual revoke the POA).

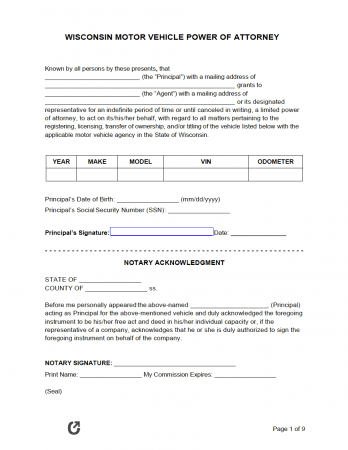

Motor Vehicle (DMV) Power of Attorney – Legally empowers motor vehicle owners to delegate duties, such as the titling and registration of their motor vehicle, to another party of their choosing.

Motor Vehicle (DMV) Power of Attorney – Legally empowers motor vehicle owners to delegate duties, such as the titling and registration of their motor vehicle, to another party of their choosing.

Laws & Signing Requirements

- Wisconsin Power of Attorney Laws – Chapter 244 & Chapter 155, “Power of Attorney for Health Care”

- State Definition of Power of Attorney (§ 244.02(9)) – “means a writing or other record that grants authority to an agent to act in the place of the principal, whether or not the term power of attorney is used.”

- State Definition of Power of Attorney for Health Care (§ 155.01(10))”means the designation, by an individual, of another as his or her health care agent for the purpose of making health care decisions on his or her behalf if the individual cannot, due to incapacity.”

- Signing Requirements