Accountant Resume Templates

An accountant resume is a document that showcases an accountant’s work experience, education, and certification. The templates accommodate accountants from all backgrounds and experience levels. For instance, an entry-level accountant or a financial executive can complete the following documents to apply for a job position.

Before writing the resume, the applicant should consider its primary purpose: to offer a skill set that the hiring company needs or wants. The candidate achieves this goal by using an organized template that highlights their best and most qualifying skills. The resume must include accurate details about the applicant’s experiences. Interviewers immediately reject prospective employees who lie or enter false information on their applications.

Table of Contents |

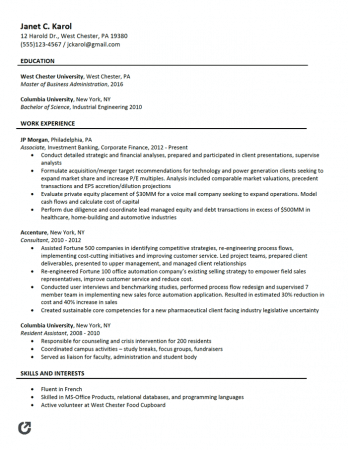

Accounting Resume Examples

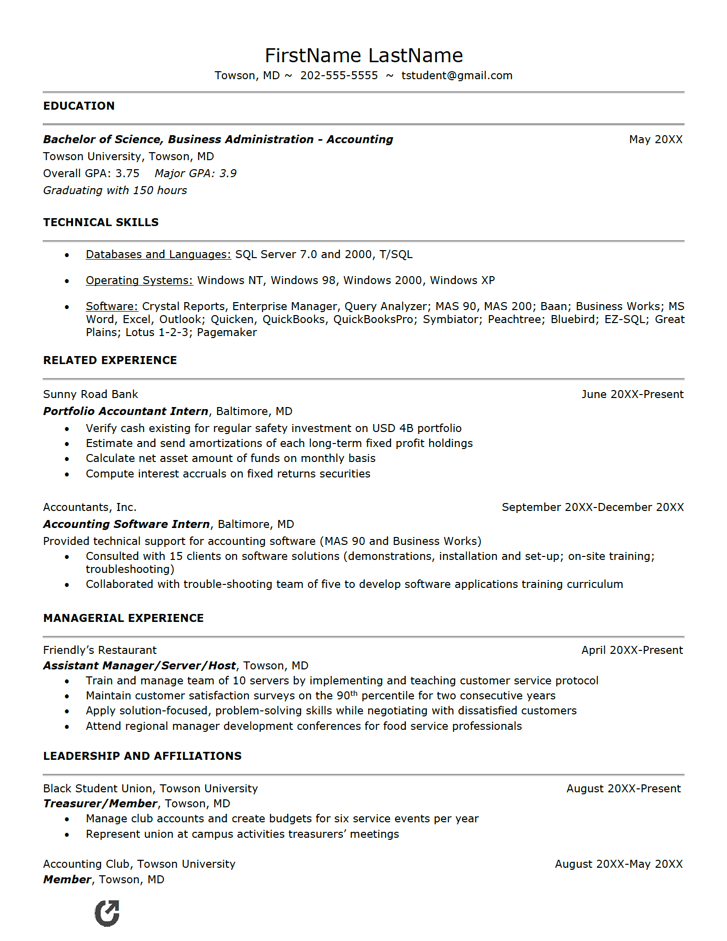

1. Word (.docx) | PDF

2. Word (.docx) | PDF

3.Word (.docx) | PDF

4. Word (.docx) | PDF

Tips for Writing an Accounting Resume

Since accounting jobs require immense attention to detail, the resume must adhere to the same standard. Make sure it is accurate and free from errors or inconsistencies. Regardless of the accountant’s career stage, the applicant must include their title, certification(s), or field-specific markers (i.e., CPA, GAAP, or QuickBooks). Providing this information increases the candidate’s credibility and raises the possibility of an interview. The placement of the title can make a difference, as well. For this reason, be sure to display it in large or bold font on the top of the page.

How to Send a ResumeAn accountant can send their resume in the following ways: e-mail, fax, or mail. The format for each type of resume must follow standard protocol. For example, if the candidate submits the resume through e-mail, they must include a “Subject” and a brief introduction. However, they must enclose a printed copy in an envelope if they send the resume via paper mail. On the envelope, they must include a stamp, the company’s address, and their return address. While faxing is the least common mode of transfer, the candidate must send their completed resume to the correct fax number if using this method. |

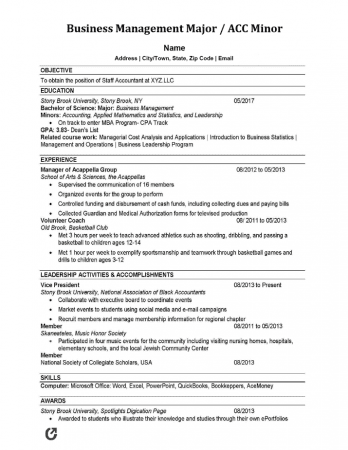

Accounting Resume Samples

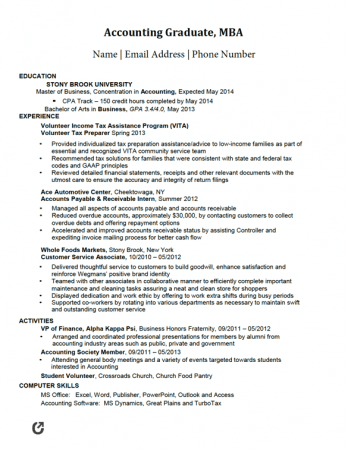

5. Word (.docx) | PDF

6. Word (.docx) | PDF

7. Word (.docx) | PDF

8. Word (.docx) | PDF

What Experience Should be Included?

The accountant’s experience level influences the information presented in the resume. “Experience” refers to the number of years worked, along with positions held, internships completed, and the names of previous employers.

Regardless of the job’s tier or ranking, the prospective employee must include previous roles or experiences that highlight their competencies. They should specifically focus on large or unique projects that set them apart from other candidates. For example, an applicant would want to include that they “managed private foundation grants totaling over $35 million” or “developed controls to reduce errors by 18%.” Similarly, they would benefit from stating that they “processed 50+ vendor invoices per month with 100% accuracy” or “prepared 10 tax returns in the previous year.”

Entry-Level Accountants

The profession considers entry-level accountants as individuals that have worked anywhere from zero (0) to two (2) years. Accountants new to the workforce have less experience than those who have been in the profession for a longer amount of time. For this reason, they must include relevant work experience, volunteer work, or additional details that demonstrate their knowledge and/or capabilities. Including applicable skills in a resume (e.g., math, auditing, banking, etc.) helps to give applicants more leverage over more experienced candidates. The goal of entry-level accountants is to find a job that allows them to gain experience and build their resumes to advance their careers. Entry-level accountant jobs include:

- Budget or financial analysts;

- Accounting clerks, assistants, associates, or representatives;

- Bookkeepers;

- Personal or private accountants; and/or

- Junior or staff accountants.

Mid-Level Accountants

A mid-level accountant has more experience than an entry-level employee as they have been in the career between two (2) and eight (8) years. They gain the critical skills needed to move onto an expert accountant role during this time. They have more responsibility and may take on managerial positions. The following list contains examples of jobs for mid-level accountants:

- Accounting manager or analyst;

- Cost accountant; and/or

- Tax, finance, or audit manager.

Senior-Level Accountants

An individual only takes on the expert accountant title if they have worked in the field for eight (8) years or more and have taken on a managerial position. Expert accountants are confident in their abilities and have a strong knowledge of the role. They may be responsible for overseeing a larger group of employees, such as a department. In addition, they may have to examine complicated financial documents and reports. Senior-level accountant jobs may have titles, such as:

- Vice president of accounting;

- Director of finance;

- Audit director;

- Senior accountant;

- Controller; and/or

- Chief financial officer.

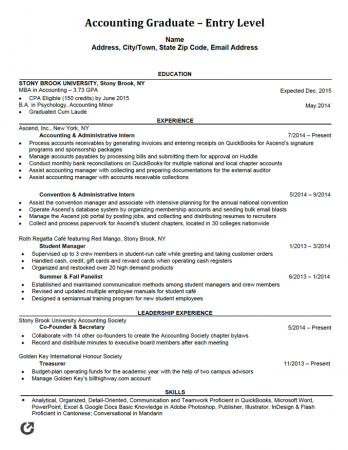

Entry Level Accounting Resumes

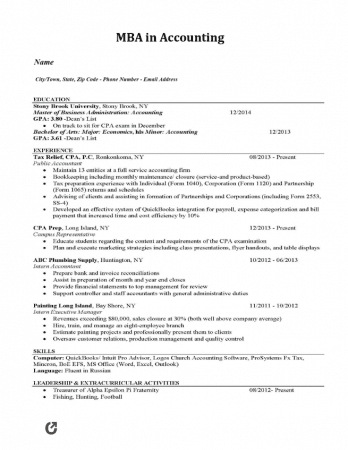

9. Word (.docx) | PDF

10. Word (.docx) | PDF

11. Word (.docx) | PDF

12. Word (.docx) | PDF

What Resume Format Should be Used?

For jobseekers with little accounting experience, a skills-based or functional resume format is best. This layout highlights the applicant’s transferable skills without spotlighting previous (and perhaps not as relevant) work experience.

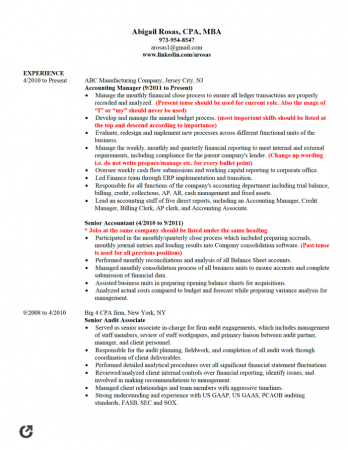

Accountants with previous accounting experience should use the reverse-chronological order format. With this type of resume, the applicant lists the most current and relevant work experience first, followed by the next most recent. This style gives the hiring personnel a brief but total picture of the applicant’s professional experience.

How to Explain Employment Gaps on a ResumeMost importantly, ensure that you are transparent as it is not uncommon to have a gap on a resume. Highlight the gap on your resume and, in your cover letter, give the company an honest explanation about why you did not work during that time. Choosing the right format can also help. For example, choosing a template emphasizing your skills, rather than your job experience, can make job recruiters more likely to request an interview. |

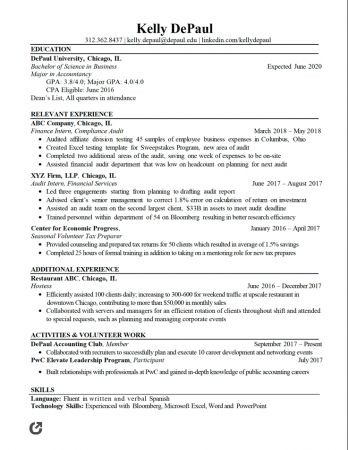

Senior Accounting Resumes

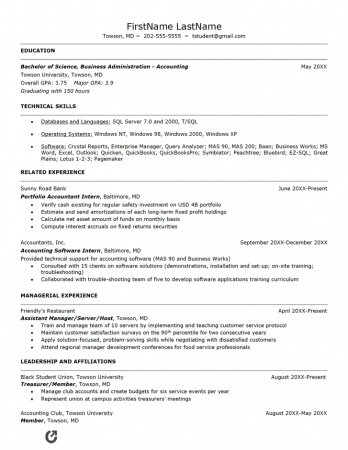

13. Word (.docx) | PDF

14. Word (.docx) | PDF

15. Word (.docx) | PDF

16. Word (.docx) | PDF

Key Takeaways

Accountants are detail-oriented, highly precise, and well-organized, and their resumes should be no different. While there is no right or wrong format or template to use, the form must be free from clutter, gimmicks, and irrelevant or inaccurate information. Most importantly, accountants should design their resumes to fit the employer’s job description.